- #How to change sales invoice no in tally erp 9 how to#

- #How to change sales invoice no in tally erp 9 serial number#

- #How to change sales invoice no in tally erp 9 registration#

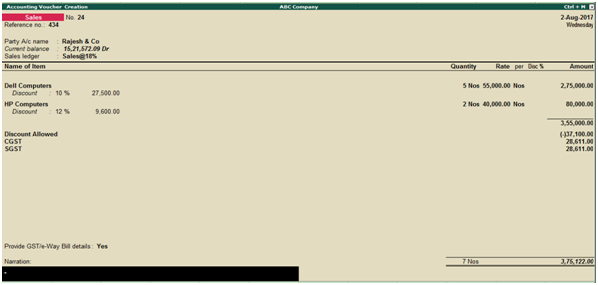

Harmonised System of Nomenclature code for goods and or Service Accounting Codes for services.Name and address of the recipient and the address of delivery, along with the name of the State and its code, if such recipient is un-registered and where the value of the taxable supply is less than fifty thousand rupees and the recipient requests that such details be recorded in the tax invoice.

#How to change sales invoice no in tally erp 9 serial number#

A consecutive serial number not exceeding sixteen characters, in one or multiple series, containing alphabets or numerals or special characters - hyphen or dash and slash symbolized as ‘_’ and “/” respectively, and any combination thereof, unique for a financial year.Name, address, and Goods and Services Tax Identification Number of the supplier.Meaning every business transaction affected by nature involving removal of goods for supply to recipient or provision of service to the recipient can only be executed by the issue of invoices to the recipient, irrespective of whether such supplier operates such business online or offline.

#How to change sales invoice no in tally erp 9 registration#

It is the prime document that serves as a bill for the service/s or product/s your business has provided.Īs per GST laws, every supplier who has acquired GST registration in India has to issue an invoice in the pre-notified format, while supplying goods or services.

#How to change sales invoice no in tally erp 9 how to#

0 kommentar(er)

0 kommentar(er)